Mortgage Calculator

Modify the values and click the Calculate button to use

Loan Details

Manual Tax & Cost Increase

Payment Breakdown

| Category | Monthly | Total |

|---|---|---|

| Principal & Interest | $2,133.40 | $768,025.13 |

| Property Taxes | $400.00 | $144,000.00 |

| Home Insurance | $125.00 | $45,000.00 |

| PMI Insurance ( PMI calculated on loan amount. ) | $16.67 | $916.67 |

| HOA Fee | $0.00 | $0.00 |

| Other Costs | $333.33 | $120,000.00 |

| Total Out-of-Pocket | $3,008.40 | $1,077,941.80 |

House Price Summary

Amortization Schedule

| Year | Date | Interest | Principal | Ending Balance |

|---|

| Month | Date | Interest | Principal | Ending Balance |

|---|

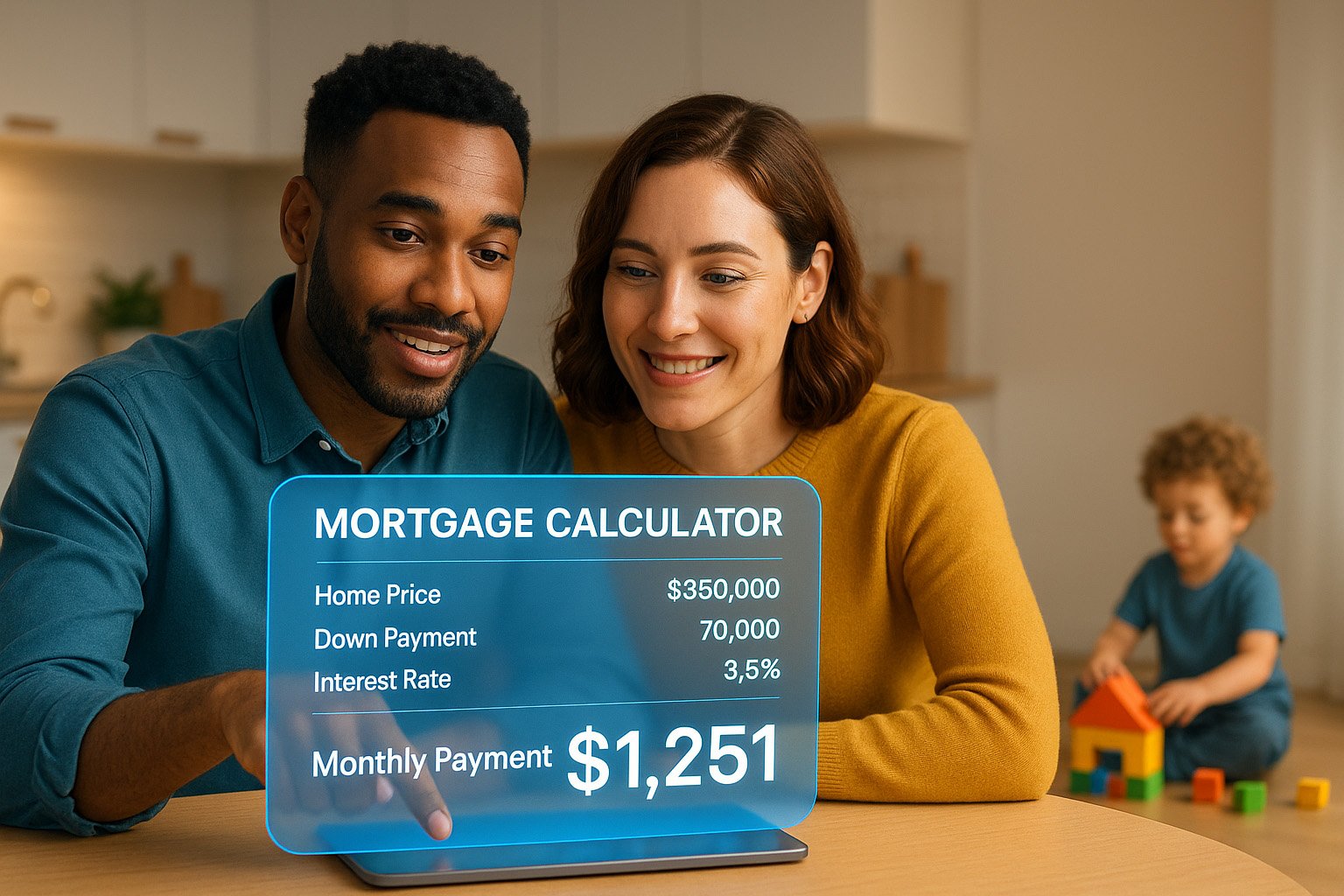

Mortgage Calculator – Estimate Monthly Home Loan Payments

Buying a home is one of the biggest financial decisions you’ll ever make. Our free Mortgage Calculator helps you estimate monthly mortgage payments, total interest costs, and overall repayment so you can plan your home loan with confidence.

What is a Mortgage?

A mortgage is a type of loan you take from a bank or financial institution to purchase a house or property. Instead of paying the full price upfront, you borrow money and repay it in monthly installments (EMIs) over several years. Each EMI includes both the principal (the loan amount) and the interest charged by the lender.

Mortgages are typically long-term commitments, often ranging from 10 to 30 years. This is why knowing your monthly mortgage payments in advance is critical for financial planning.

How Does the Mortgage Calculator Work?

Our Mortgage Calculator uses three main inputs to determine your monthly payments:

- Loan Amount: The total amount you are borrowing for your home.

- Interest Rate: The annual interest rate charged by your lender.

- Loan Tenure: The repayment period in years.

By applying the standard mortgage formula, the calculator provides:

- Monthly mortgage payment (EMI)

- Total interest payable

- Total repayment amount (principal + interest)

This helps you understand the true cost of your mortgage and compare different loan offers before making a decision.

Why Use a Mortgage Calculator?

- ✅ Helps you plan your home loan before applying

- ✅ Saves time by giving instant results

- ✅ Lets you compare different mortgage options

- ✅ Works for first-time buyers, refinancing, and investment properties

How to Use This Calculator

- Enter the loan amount (price of the home minus your down payment).

- Input the annual interest rate offered by the bank.

- Choose the loan tenure (e.g., 15 years, 20 years, 30 years).

- Click “Calculate” to see your monthly mortgage payment, total interest, and total repayment amount.

Example Mortgage Calculation

Suppose you buy a home worth $200,000 with a down payment of $40,000. You borrow $160,000 at an interest rate of 6% for 20 years. Using our Mortgage Calculator:

- Monthly Payment ≈ $1,146

- Total Interest Payable ≈ $114,000

- Total Repayment (Principal + Interest) ≈ $274,000

This example shows why calculating your mortgage in advance is so important. A small difference in interest rate or loan term can significantly affect your monthly budget.

Other Useful Financial Tools

At Money Matrix Guide, we offer multiple free tools to simplify financial decisions:

- Loan EMI Calculator – calculate monthly installments for any type of loan

- Credit Card Interest Calculator – estimate monthly interest on your credit card balance

- Credit Card Payoff Calculator – create a plan to clear debt faster

- Balance Transfer Savings Calculator – check savings from switching credit cards

- Credit Card Comparison Tool – compare and find the best credit card

We’re also partnered with PDF Tools Guru, providing free PDF converters, calculators, and productivity tools for everyday use.

FAQs About Mortgage Calculator

Can this calculator be used for refinancing?

Yes, it can help you compare your current mortgage with new refinancing options.

Does the calculator include property taxes and insurance?

No, it only calculates principal and interest. Always check total costs with your lender.

Is the Mortgage Calculator accurate?

Yes, it uses the standard mortgage EMI formula. However, actual payments may vary slightly due to rounding or lender-specific fees.

What loan tenures can I calculate?

You can calculate mortgages for 5 years, 10 years, 20 years, 30 years, or any custom period.

Conclusion

A mortgage is a long-term financial responsibility, and knowing your repayment schedule in advance can make all the difference. Use our Mortgage Calculator to plan your home loan, understand interest costs, and choose the mortgage that fits your budget.

Start calculating today and explore more free tools at Money Matrix Guide.